estate tax changes proposed 2021

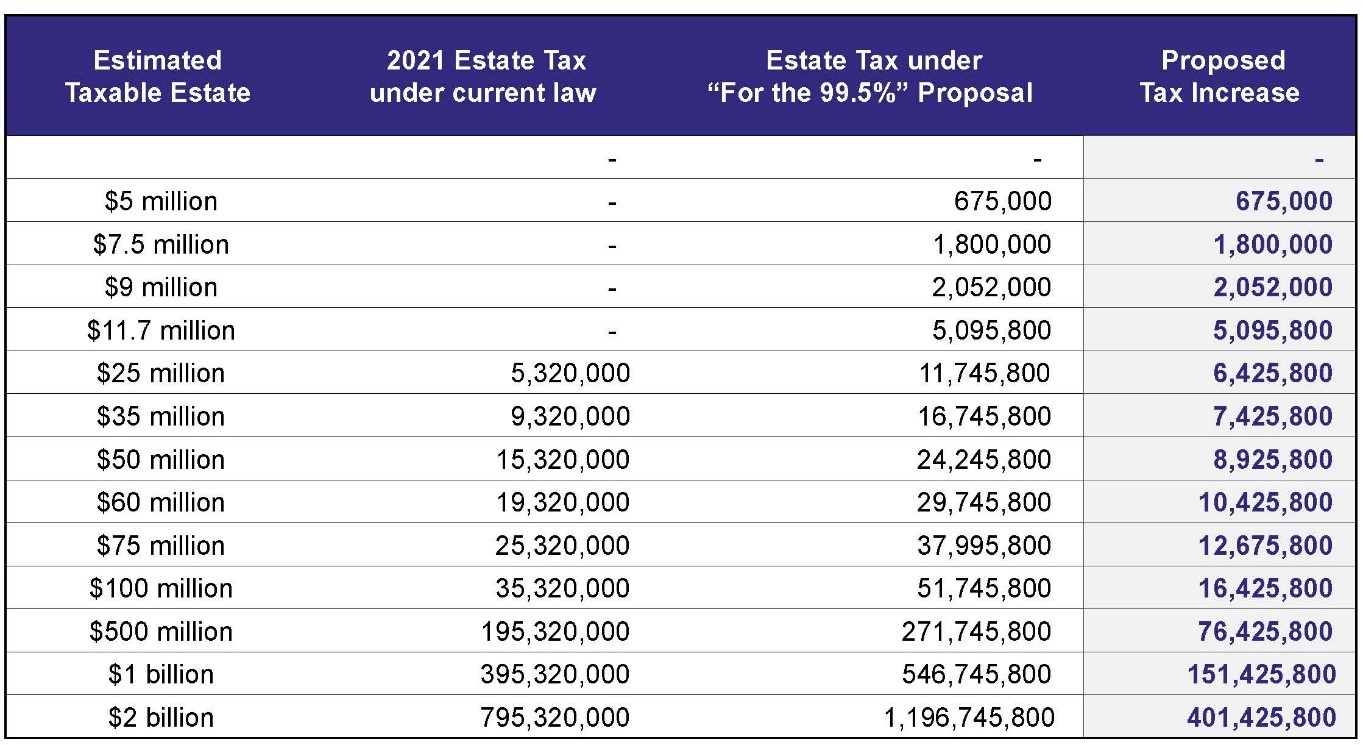

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. July 13 2021.

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

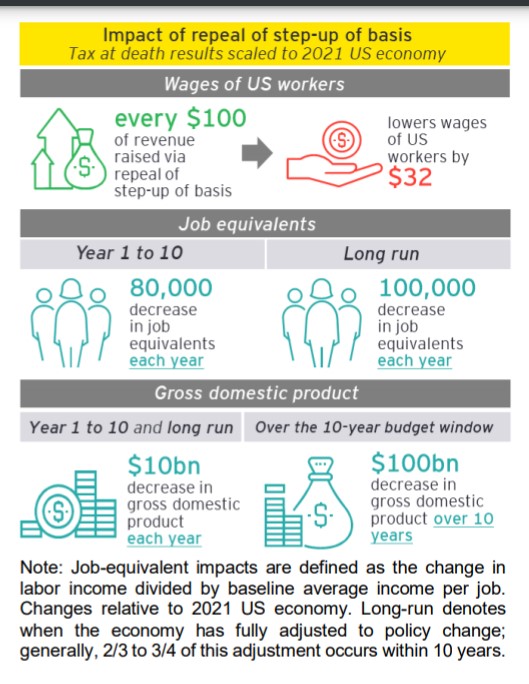

Administration has proposed to tax capital gains when transferred by gift or at death.

. Stepped-up basis refers to having the propertys usual inherited basis increased or. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have.

New Jersey Tax Calendar January 1 2021 December 31 2021 This calendar is for use by both businesses and individuals. We will mail checks to qualified applicants as. But it wouldnt be a surprise if the estate tax.

The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption. That is only four years away and. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. Basis represents for tax purposes the original cost or capital investment for a property. The maximum estate tax rate would increase from 39 to 65.

Inflation in 1000 increments and will rise to 15000 in 2018 and remain at that level in 2021. The IRS in Notice 2022-53 has announced that the agency will not impose penalties on failures to take specified RMDs for 2021 and 2022 that were required under provisions of. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

As of January 1 2021 the death tax exemption in Washington DC. Estate Tax Law Changes - What To Do Now. Decreased from 567 million to 4 million.

One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts.

The deadline for filing your ANCHOR benefit application is December 30 2022. 234 million for married couples at a top rate of 40. The first is the federal estate tax exemption.

Decrease in Exemptions on State Death Taxes. Although many forms are listed it is not. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. ANCHOR payments will be paid. Estate and gift tax exemption.

If Grandma does no gifting. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. Since 2018 estates are only taxed once they exceed 117 million for individuals.

So if a resident. The current 2021 gift and estate tax exemption is 117 million for each US. We will begin paying ANCHOR benefits in the late Spring of 2023.

The Biden Administration has proposed significant changes to the. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. One of the tax increases proposed by President Biden during his campaign was a reduction in the estate tax exemption taxing amounts transferred to heirs in excess of.

Are Major Tax Changes Ahead K T Williams Law

Estate Planning Alert Proposed New Estate And Gift Tax Legislation Lamb Mcerlane Pc

Estate Tax Current Law 2026 Biden Tax Proposal

Estate Tax Landscape For 2021 And Beyond

Estate Taxes Under Biden Administration May See Changes

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Biden Administration Tax Plan Estate Tax Tax Cuts And Jobs Act And Step Up In Basis Rule Castle Wealth Group

Major Tax Changes Are Coming What Lies Ahead For Estates

Estate Tax Law Changes What To Do Now

What Happened To The Expected Year End Estate Tax Changes

Illinois Grain Farms Potential Impact Of Estate Tax Changes Agfax

Biden Tax Plan May Leave Estate Tax Alone But Kill Step Up Provision Insurancenewsnet

163 Proposed Tax Changes For 2021 Taxes Impact Your Bottom Line Calibrate Real Estate Blog

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

Gift And Estate Tax Changes Stark Stark Jdsupra

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Estate Tax Changes Under Biden How To Prepare Affluent And Wealthy Clients Thinkadvisor

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt